CN reports Q4-2017 and full-year financial results

Quarter caps strong 2017 performance with top line growth of over C$1 billion; record investments planned in 2018 to deliver future growth

MONTREAL, Jan. 23, 2018 /CNW/ - CN (TSX: CNR) (NYSE: CNI) today reported its financial and operating results for the fourth quarter and year ended Dec. 31, 2017.

Financial results highlights

Fourth-quarter 2017 compared to fourth-quarter 2016

- Net income increased by 156 per cent to C$2,611 million, and diluted earnings per share (EPS) increased by 164 per cent to C$3.48. Included in net income was a deferred income tax recovery of C$1,764 million (C$2.35 per diluted share) resulting from the enactment of a lower U.S. federal corporate income tax rate.

- Adjusted net income decreased by six per cent to C$897 million, and adjusted diluted EPS decreased by two per cent to C$1.20. (1)

- Operating income decreased by seven per cent to C$1,301 million.

- Revenues increased by two per cent to C$3,285 million.

- Revenue ton-miles (RTMs) increased by one per cent and carloadings increased by seven per cent.

- Operating expenses increased by nine per cent to C$1,984 million.

- Operating ratio of 60.4 per cent, an increase of 3.8 points.

Full-year 2017 compared to full-year 2016

- Net income increased by 51 per cent to C$5,484 million, and diluted EPS increased by 55 per cent to C$7.24. Included in net income was a deferred income tax recovery of C$1,764 million (C$2.33 per diluted share) resulting from the enactment of a lower U.S. federal corporate income tax rate.

- Adjusted net income increased by six per cent to C$3,778 million, and adjusted diluted EPS increased by nine per cent to C$4.99. (1)

- Operating income increased by five per cent to C$5,558 million.

- Revenues increased by eight per cent to C$13,041 million.

- RTMs increased by 11 per cent and carloadings increased by 10 per cent.

- Operating expenses increased by 11 per cent to C$7,483 million.

- Operating ratio of 57.4 per cent, an increase of 1.5 points.

- Free cash flow (1) was C$2,778 million, compared with C$2,520 million for 2016.

"Our growth continues to outpace the strengthening economy, and I am pleased with the results our dedicated team generated in 2017," said Luc Jobin, CN president and chief executive officer. "Throughout the year we faced rapidly changing market demands and in the fourth quarter dealt with challenging operating conditions, including harsh early winter weather across the network, impacting our performance.

"We remain focused on operational efficiency and providing quality service to our customers," Jobin continued. "In 2018 we are adding new train crews and increasing our capital program to a record C$3.2 billion as we invest in locomotives and build additional capacity for resiliency."

2018 outlook, capital program and increased dividend (2)

"As the economic backdrop remains favourable in North America, we expect to see continued volume growth in 2018," said Jobin.

CN aims to deliver adjusted diluted EPS in the range of C$5.25 to C$5.40 this year compared to adjusted diluted EPS of C$4.99 in 2017. (1)

CN will continue to invest in the safety and efficiency of its network with a capital program in 2018 of C$3.2 billion. The program is highlighted by approximately $700 million for investments to increase capacity, including the acquisition of 60 new locomotives, track infrastructure expansion, and improvements at intermodal terminals. The capital program also includes approximately C$1.6 billion for track infrastructure maintenance supporting safety and efficiency, and approximately C$400 million for continued installation of Positive Train Control in the United States.

The Company's Board of Directors today approved a 10 per cent increase to CN's 2018 quarterly cash dividend, effective for the first quarter of 2018.

Foreign currency impact on results

Although CN reports its earnings in Canadian dollars, a large portion of its revenues and expenses is denominated in U.S. dollars. The fluctuation of the Canadian dollar relative to the U.S. dollar affects the conversion of the Company's U.S.-dollar-denominated revenues and expenses. On a constant currency basis, (1) CN's net income for the three months and year ended Dec. 31, 2017 would have been higher by C$26 million (C$0.03 per diluted share) and C$42 million (C$0.06 per diluted share), respectively.

Fourth-quarter 2017 revenues, traffic volumes and expenses

Revenues for the quarter increased by two per cent to C$3,285 million, when compared to the same period in 2016. Revenues increased for metals and minerals (20 per cent), intermodal (13 per cent), coal (seven per cent) and automotive (one per cent). Revenues declined for grain and fertilizers (10 per cent), petroleum and chemicals (five per cent), forest products (two per cent) and other revenues (one per cent).

The increase in revenues was mainly attributable to higher international container traffic via the ports of Prince Rupert and Vancouver, and increased volumes of frac sand; freight rate increases; and higher applicable fuel surcharge rates. These factors were partly offset by the negative translation impact of a stronger Canadian dollar; lower export volumes of U.S. soybeans and reduced shipments of crude oil.

Carloadings for the quarter increased by seven per cent to 1,461 thousand.

RTMs, measuring the relative weight and distance of rail freight transported by CN, increased by one per cent. Rail freight revenue per RTM also increased by one per cent.

Operating expenses for the quarter increased by nine per cent to C$1,984 million, mainly due to higher costs from increased volumes; challenging operating conditions, including harsh early winter weather; and higher fuel prices; partly offset by the positive translation impact of a stronger Canadian dollar.

Full-year 2017 revenues, traffic volumes and expenses

Revenues for 2017 increased by eight per cent to C$13,041 million, when compared to 2016. Revenues increased for metals and minerals (25 per cent), coal (23 per cent), intermodal (12 per cent), automotive (nine per cent), grain and fertilizers (six per cent), other revenues (five per cent), and petroleum and chemicals (two per cent). Revenues declined for forest products (one per cent).

The increase in revenues was mainly attributable to higher volumes of traffic in overseas intermodal, frac sand, coal and petroleum coke exports, and Canadian grain; freight rate increases; and higher applicable fuel surcharge rates; partly offset by the negative translation impact of a stronger Canadian dollar.

Carloadings increased by 10 per cent to 5,737 thousand.

RTMs increased by 11 per cent. Rail freight revenue per RTM decreased by two per cent, mainly driven by an increase in the average length of haul and the negative translation impact of a stronger Canadian dollar; partly offset by freight rate increases and higher applicable fuel surcharge.

Operating expenses increased by 11 per cent to C$7,483 million, mainly due to higher costs from increased volumes and higher fuel prices, partly offset by the positive translation impact of a stronger Canadian dollar.

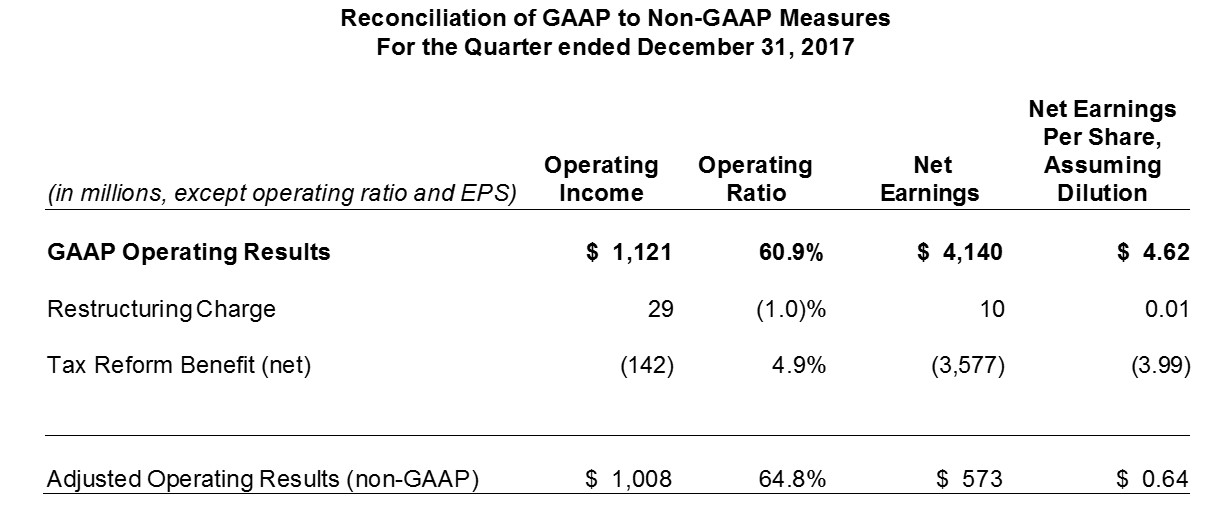

(1) Non-GAAP Measures

CN reports its financial results in accordance with United States generally accepted accounting principles (GAAP). CN also uses non-GAAP measures in this news release that do not have any standardized meaning prescribed by GAAP, including adjusted performance measures, constant currency, and free cash flow. These non-GAAP measures may not be comparable to similar measures presented by other companies. For further details of these non-GAAP measures, including a reconciliation to the most directly comparable GAAP financial measures, refer to the attached supplementary schedule, Non-GAAP Measures.

CN's full-year adjusted EPS outlook (2) excludes the expected impact of certain income and expense items. However, management cannot individually quantify on a forward-looking basis the impact of these items on its EPS because these items, which could be significant, are difficult to predict and may be highly variable. As a result, CN does not provide a corresponding GAAP measure for, or reconciliation to, its adjusted EPS outlook.